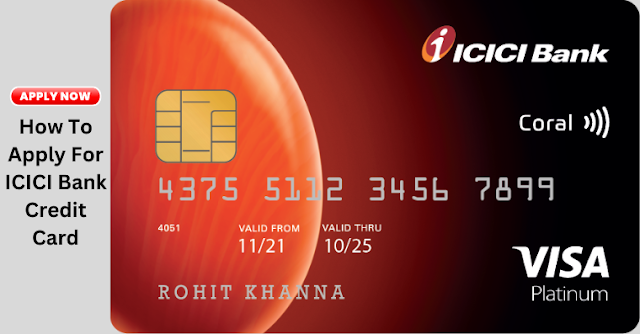

How To Apply For ICICI Bank Credit Card

A credit card is a very useful instrument that enables you to make purchases on credit that you can then pay off later. In addition to allowing you to carry less cash, Credit Cards provide various other advantages. The procedure of obtaining a credit card has been greatly simplified. If you’ve been wondering if it’s possible to apply for a credit card online, then this guide can help you to figure it out.

Are online Credit Card applications accepted?

A few years ago, obtaining a credit card required you to visit your bank and complete a paper application. You may easily do this now online. The majority of banks and financial institutions allow you to apply for a card from the convenience of your home. The quickest and easiest way is to apply for a credit card online. It not only speeds up the application processing time but also enables you to compare several Credit Card offers at once.

You could even get pre-approved offers or fast acceptance, depending on your bank’s evaluation of your financial situation. With your bank. Your registration for a credit card, however, is still based on your ability to meet the credit card eligibility requirements. Some of the rules that you may have to meet in order to apply are listed below.

Eligibility Criteria of ICICI Credit Card

The person must be either a citizen of India or indeed a non-resident Indian (NRI).

The applicant’s minimum age must not be under 18 years.

The candidate must have a steady source of income and meet the minimum income standards.

The candidate should have excellent credit.

Collect all Records and Information

This is a crucial step that many individuals overlook when applying for a credit card. Before filling out your application make sure you have all of the necessary documents and information. This will not only speed up the procedure but will also save you from making mistakes that might lead to rejection.

Carefully read the terms and conditions

Another important step that many applicants overlook is reviewing the terms and conditions of a credit card. Reading and understanding the terms is critical since it allows you to learn more about credit cards and the restrictions associated with their use. The terms and conditions explain everything from the prices to the limitations and restrictions.

How to submit an online Credit Card application?

While the application process may differ significantly amongst the main credit card provider, the fundamental steps are generally the same. You may get a rough understanding of how to apply for a credit card online by reading the steps that follow:

First, go to the website of your bank or credit card company and click on the link to the credit card area.

Then you may review various credit cards that are offered, their features, terms and conditions, and fees.

Once you’ve determined which credit card is best for you, click the link to access the online application process.

The website will link you to an online application form where you must enter all the required information and upload electronic copies of any required papers.

Before submitting your application, make sure there are no errors or blank fields by checking it twice. Click submit after you’re finished, then wait while the bank processes your application.

Conclusion

ICICI Bank give you an easy option to apply for an ICICI Bank credit card online, through a user-friendly and simple-to-use web platform. You have a variety of alternatives, including secured cards, and NRI credit cards. Amazon Pay cards, travel and fuel credit cards among others. Visit the ICICI Bank website right away to review various credit cards offered and to submit an online application for the card that most closely matches your financial requirements

Comments

Post a Comment